MT Declaration of Homestead free printable template

Show details

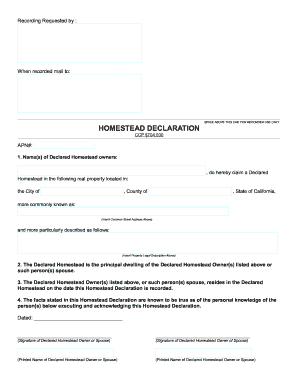

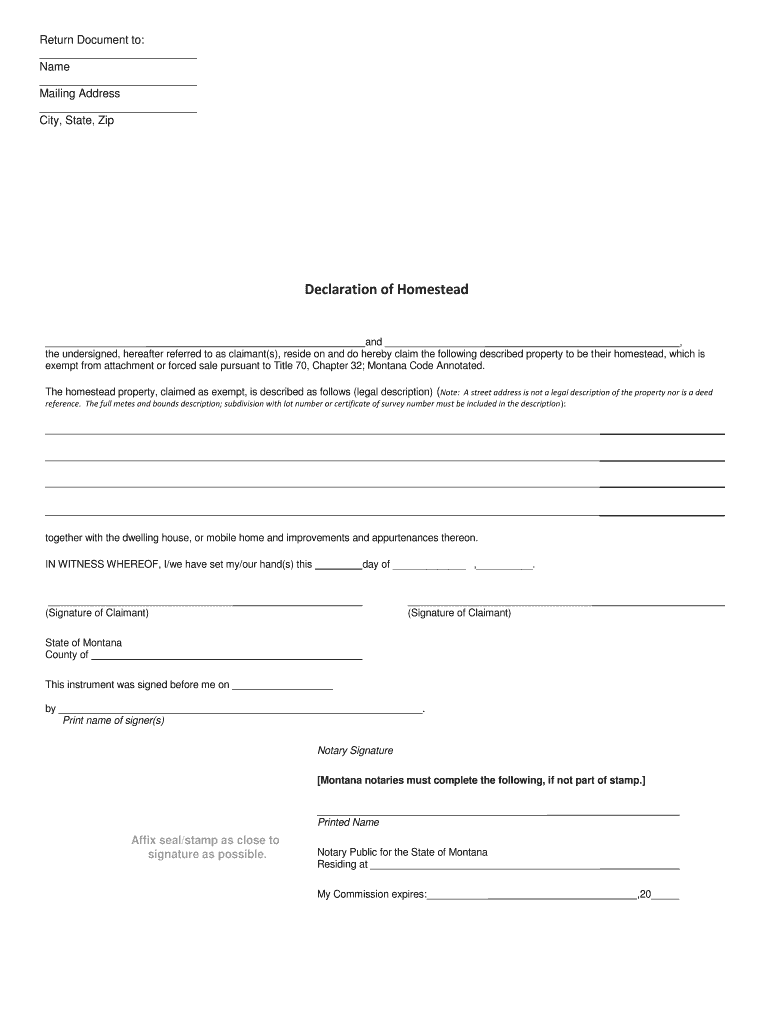

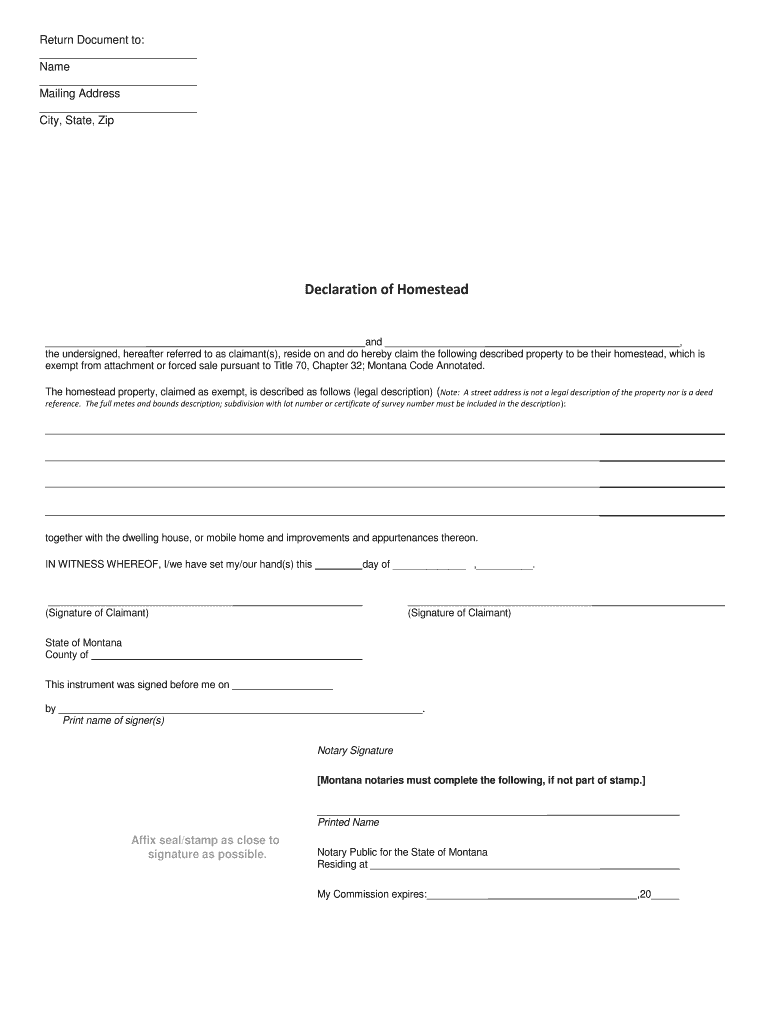

Return Document to: Name Mailing Address City, State, Zip Declaration of Homestead and, the undersigned, hereafter referred to as claimant(s), reside on and do hereby claim the following described

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign montana homestead form

Edit your montana homestead exemption form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your montana declaration form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing montana homestead act form online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit annotated declaration montana form. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out state of montana homestead act form

How to fill out MT Declaration of Homestead

01

Obtain the MT Declaration of Homestead form from your local county office or download it from the state website.

02

Fill in your name and address as the property owner.

03

Provide a description of the property you are declaring as your homestead, including parcel number and legal description.

04

Indicate whether the property is your primary residence.

05

Sign and date the form to affirm the information is accurate.

06

Submit the completed form to your county clerk or recorder's office, ensuring you keep a copy for your records.

Who needs MT Declaration of Homestead?

01

Homeowners in Montana who wish to protect their primary residence from certain creditors.

02

Individuals looking for property tax exemptions or reductions.

03

Anyone wanting to formally declare their primary dwelling as their homestead for legal or financial reasons.

Fill

montana homestead exemption

: Try Risk Free

People Also Ask about montana homestead declaration

How does the homestead Act work in Montana?

The Homestead Act of 1862 enabled thousands to claim land in Montana. This act offered 160 acres of public land to US citizens on the condition that they live on, cultivate, and improve it. They could then "prove up" and obtain a deed after five years.

How do I declare a homestead in Montana?

How do I declare a homestead in Montana? The owner completes, signs, and has the Montana homestead declaration notarized. The owner then files the document in the office of the clerk and recorder in the county in which the home is located. If married, both spouses should sign the declaration and live on the property.

What is the homeowners exemption in Montana?

The 67th Montana Legislature also passed a statute requiring the homestead declaration to increase by four percent every calendar year after 2021. In 2022 the homestead exemption will be $364,000; $378,560 in 2023; and $393,702 in 2024 and so on.

How do I file a declaration of homestead in Montana?

How do I declare a homestead in Montana? The owner completes, signs, and has the Montana homestead declaration notarized. The owner then files the document in the office of the clerk and recorder in the county in which the home is located. If married, both spouses should sign the declaration and live on the property.

How much is the homestead exemption in Montana?

By signing a legal document known as a homestead declaration, Montanans can protect up to $250,000 in value of a home against most creditors' claims.

How do I file for homestead exemption in Montana?

In Montana, you must file a homestead declaration (a form filed with the county recorder's office to put on record your right to a homestead exemption) before you file for bankruptcy to claim the homestead exemption. Contact your county recorder for information on how to file a homestead declaration.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my homestead declaration montana in Gmail?

The pdfFiller Gmail add-on lets you create, modify, fill out, and sign montana homestead declaration form and other documents directly in your email. Click here to get pdfFiller for Gmail. Eliminate tedious procedures and handle papers and eSignatures easily.

How do I make edits in montana homestead act application without leaving Chrome?

Download and install the pdfFiller Google Chrome Extension to your browser to edit, fill out, and eSign your homestead exemption montana, which you can open in the editor with a single click from a Google search page. Fillable documents may be executed from any internet-connected device without leaving Chrome.

How do I fill out how to fill out mt primary residence from certain creditors using my mobile device?

You can easily create and fill out legal forms with the help of the pdfFiller mobile app. Complete and sign montana declaration of homestead form and other documents on your mobile device using the application. Visit pdfFiller’s webpage to learn more about the functionalities of the PDF editor.

What is MT Declaration of Homestead?

The MT Declaration of Homestead is a legal document filed by homeowners in Montana to declare their property as their primary residence, providing certain protections against creditors and ensuring eligibility for tax benefits.

Who is required to file MT Declaration of Homestead?

Homeowners in Montana who wish to protect their primary residence from certain creditors are required to file the MT Declaration of Homestead.

How to fill out MT Declaration of Homestead?

To fill out the MT Declaration of Homestead, homeowners need to complete the designated form with details about the property, including the address, the name of the homeowner(s), and any other required information, and then file it with the local county clerk and recorder.

What is the purpose of MT Declaration of Homestead?

The purpose of the MT Declaration of Homestead is to safeguard a homeowner's primary residence from certain types of creditors and to qualify for property tax benefits in Montana.

What information must be reported on MT Declaration of Homestead?

The MT Declaration of Homestead must include the property address, names of the homeowners, and a declaration that the property is the primary residence of the homeowners.

Fill out your MT Declaration of Homestead online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Montana Homestead Form Blank is not the form you're looking for?Search for another form here.

Keywords relevant to declaration of homestead montana form

Related to homestead act montana

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.