Get the free montana homestead exemption form

Show details

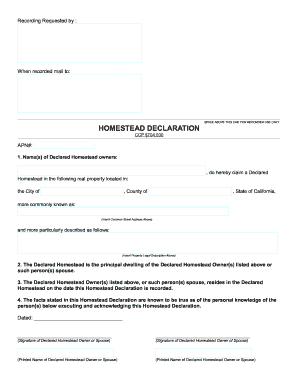

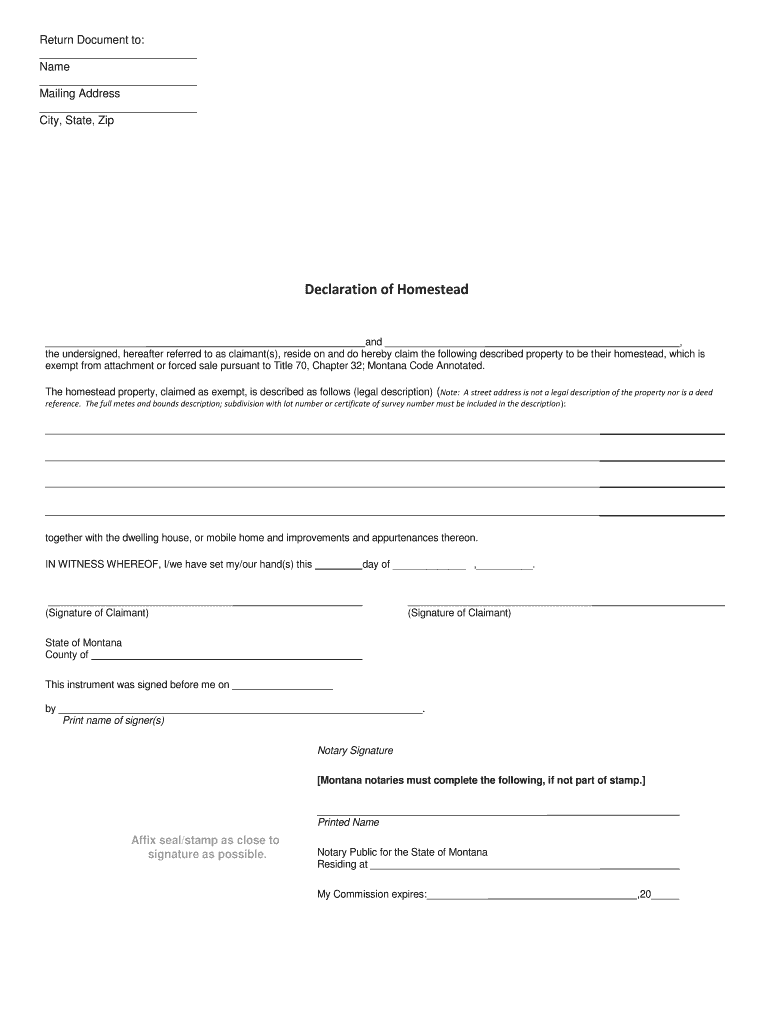

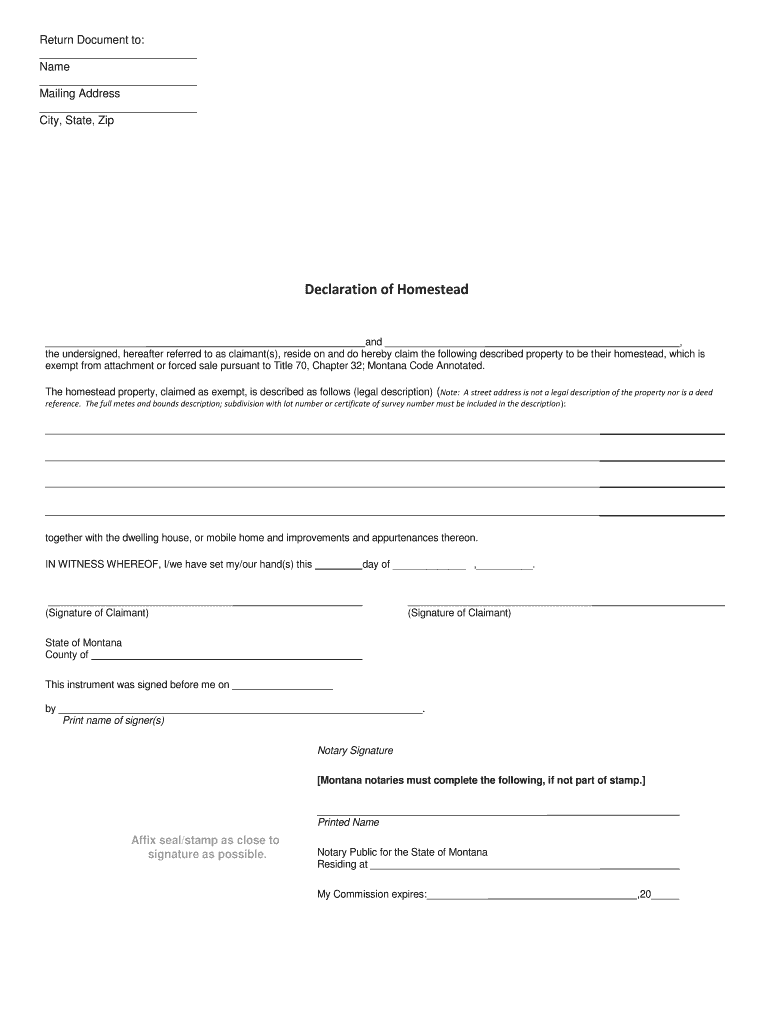

Return Document to: Name Mailing Address City, State, Zip Declaration of Homestead and, the undersigned, hereafter referred to as claimant(s), reside on and do hereby claim the following described

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign

Edit your montana homestead exemption form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your montana homestead exemption form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing montana homestead exemption form online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit homestead exemption montana form. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

How to fill out montana homestead exemption form

How to fill out Montana homestead exemption:

01

Gather all necessary documentation, such as proof of residence and income, property tax information, and any other required forms or supporting documents.

02

Complete the application form accurately and thoroughly, ensuring that all required fields are filled out.

03

Attach any required documentation or proofs as specified by the application instructions.

04

Review the completed application to ensure accuracy and completeness.

05

Submit the application and any supporting documents either in person or by mail to the appropriate Montana government agency responsible for handling homestead exemption applications.

Who needs Montana homestead exemption:

01

Montana residents who own and occupy their primary residence as their permanent home may be eligible for the homestead exemption.

02

The homestead exemption is primarily aimed at providing property tax relief to homeowners who could face financial hardships due to increasing property values or taxes.

03

Eligibility requirements may vary, so it is advisable to check with the specific Montana county's tax assessor's office or the Montana Department of Revenue for more detailed information on who qualifies for the homestead exemption.

Fill montana homestead tax exemption : Try Risk Free

People Also Ask about montana homestead exemption form

How does the homestead Act work in Montana?

How do I declare a homestead in Montana?

What is the homeowners exemption in Montana?

How do I file a declaration of homestead in Montana?

How much is the homestead exemption in Montana?

How do I file for homestead exemption in Montana?

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What information must be reported on montana homestead exemption?

Montana homeowners may be eligible for a homestead exemption which allows a certain amount of their home's value to be exempt from property taxes. To qualify, the homeowner must have lived in the home as of January 1 of the tax year, and must be the owner of record or the contract holder of the home. The exemption amount is based on the value of the home, and the amount of the exemption is determined by the county in which the home is located. Information that must be reported on a Montana homestead exemption includes the owner's name, address, and date of birth, the date of purchase, the assessed value of the home, and the amount of the exemption.

What is the penalty for the late filing of montana homestead exemption?

The penalty for the late filing of a Montana homestead exemption is a 5% late filing fee, which is calculated on the amount of the exemption claimed.

What is montana homestead exemption?

The Montana homestead exemption is a legal provision that protects a certain amount of a resident's property from being sold to satisfy unpaid debts or creditors. It allows homeowners to claim a portion of their property as exempt and beyond the reach of creditors.

In Montana, the homestead exemption amount varies depending on the location of the property. As of 2021, the exemption amount is $250,000 for properties located in cities or towns, and $300,000 for properties located outside cities or towns.

The homestead exemption is designed to provide homeowners with a level of protection and help them maintain a place to live, even in the face of financial difficulties or bankruptcy. However, it's important to note that the exemption does not apply to certain types of debts, such as mortgages, property taxes, or mechanic's liens.

It is advisable to consult with a legal professional or bankruptcy attorney for specific guidance on how the Montana homestead exemption applies to your personal situation.

Who is required to file montana homestead exemption?

In Montana, any resident homeowner is eligible to file for the Montana Homestead Exemption if they meet the requirements. However, the exemption is not automatic and homeowners are required to file an application with their local county assessor's office to claim the exemption.

How to fill out montana homestead exemption?

To fill out the Montana Homestead Exemption, you can follow these steps:

1. Obtain the Homestead Exemption Application form: You can download the Homestead Exemption Application form from the Montana Department of Revenue website or get a physical copy from the local county treasurer's office.

2. Provide personal and property information: Fill out the form with your personal details, including your name, address, phone number, and Social Security number. You will also need to provide information about the property you wish to claim the exemption for, such as the address and legal description.

3. Indicate property ownership: Provide details about the nature of your property ownership, including whether you solely own the property or if there are other co-owners.

4. Tax status and residency: Indicate your tax status, such as whether you are currently filing Montana income tax returns, and your residency status in Montana (primary residence or seasonal dwelling).

5. Income verification: If you are eligible for the low-income Homestead Exemption, you will need to provide income verification documentation, such as previous year's federal income tax return or other supporting documents.

6. Optional additional benefit programs: Indicate if you would like to apply for optional additional benefit programs, such as the Elderly Homeowner/Renter Credit or the Disabled Homeowner/Renter Credit.

7. Sign and date: Read through the form carefully, ensure all necessary information is provided, and sign the application form. If you have co-owners, they will also need to sign the form.

8. Submit the application: After filling out the form, make a copy for your records and submit the original application to your county treasurer's office by mail or in person. Check your local county procedures for submission instructions or additional required documents that may vary by county.

It's important to note that the Montana Homestead Exemption has specific deadlines, so be sure to submit your application within the designated timeframe to be eligible for the exemption.

What is the purpose of montana homestead exemption?

The purpose of the Montana Homestead Exemption is to protect a portion of a homeowner's property value from being seized or sold in order to satisfy debts or claims by creditors. This exemption allows Montana homeowners to retain a designated amount of equity in their primary residence, ensuring they have a place to live even if facing financial difficulties. The homestead exemption is meant to provide a level of stability and security for homeowners, preventing them from being completely deprived of their property in times of financial distress.

How do I modify my montana homestead exemption form in Gmail?

The pdfFiller Gmail add-on lets you create, modify, fill out, and sign homestead exemption montana form and other documents directly in your email. Click here to get pdfFiller for Gmail. Eliminate tedious procedures and handle papers and eSignatures easily.

How do I make edits in montana homestead exemption without leaving Chrome?

Download and install the pdfFiller Google Chrome Extension to your browser to edit, fill out, and eSign your montana homestead, which you can open in the editor with a single click from a Google search page. Fillable documents may be executed from any internet-connected device without leaving Chrome.

How do I fill out montana homestead declaration form using my mobile device?

You can easily create and fill out legal forms with the help of the pdfFiller mobile app. Complete and sign declaration of homestead montana form and other documents on your mobile device using the application. Visit pdfFiller’s webpage to learn more about the functionalities of the PDF editor.

Fill out your montana homestead exemption form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Montana Homestead Exemption is not the form you're looking for?Search for another form here.

Keywords relevant to montana homestead declaration form

Related to homestead act in montana

If you believe that this page should be taken down, please follow our DMCA take down process

here

.